telanova blog

telanova: the outsourced IT team that feels like your own.

Keep up to date with the latest news and articles from the world of IT and telanova. Providing advice, consultancy, helpdesk, monitoring and maintenance, updates, upgrades, security: all the things your in-house team would do, but better and at a fraction of the cost and hassle.

How to Share a Calendar in Outlook (Microsoft 365): A Quick Guide

By Telanova | 17 December 2025

Managed IT vs Break-Fix: Which IT Support Model Helps Your Business Grow?

By Telanova | 03 December 2025

How to Repair the EFI Bootloader on a GPT Hard Drive for Windows

By Telanova | 26 November 2025

Keeping Your Devices Secure: A Guide to Cyber Security, Device Compliance, and Intune Auto-Updates

By Telanova | 19 November 2025

Translating Business Continuity and Disaster Recovery IT Jargon

By Telanova | 12 November 2025

Managing Microsoft 365: User Administration and Exchange Online Support

By Telanova | 05 November 2025

Discover Microsoft Forms: A Hidden Microsoft 365 Tool for Surveys & Feedback

By Telanova | 22 October 2025

Wired vs. Wireless Network Connections in the Workplace: What's Best for You?

By Telanova | 15 October 2025

How To: Deploying Software to Multiple Devices - Group Policy vs. Microsoft Intune

By Telanova | 17 September 2025

Why Monitoring Risky Sign-ins in Microsoft 365 is Essential for Your Business

By Telanova | 10 September 2025

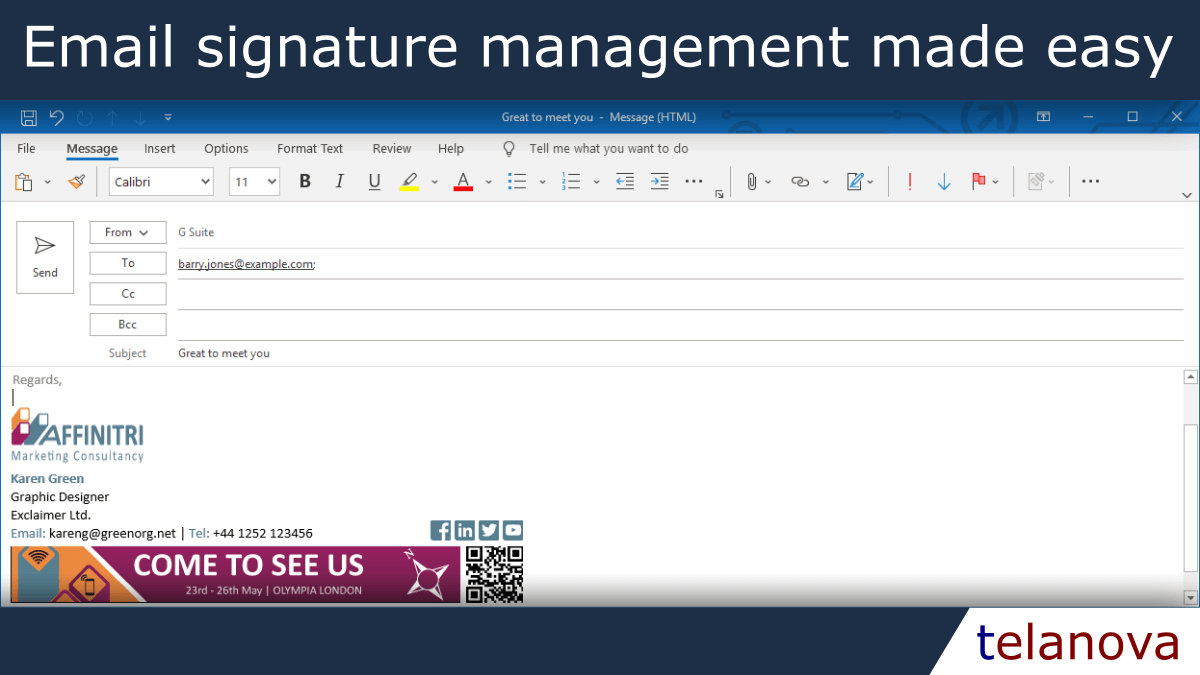

Why Small Businesses Should Use Exclaimer for Email Signatures

By Telanova | 03 September 2025

Designing a Folder/File Sharing Structure for Small and Medium Businesses (SMBs)

By Telanova | 27 August 2025

What the M&S and Co-op Ransomware Attacks Mean for Your Business

By Telanova | 20 August 2025

Why You Still Need to Back Up Cloud Data (Even Microsoft 365 & Google Workspace)

By Telanova | 23 July 2025

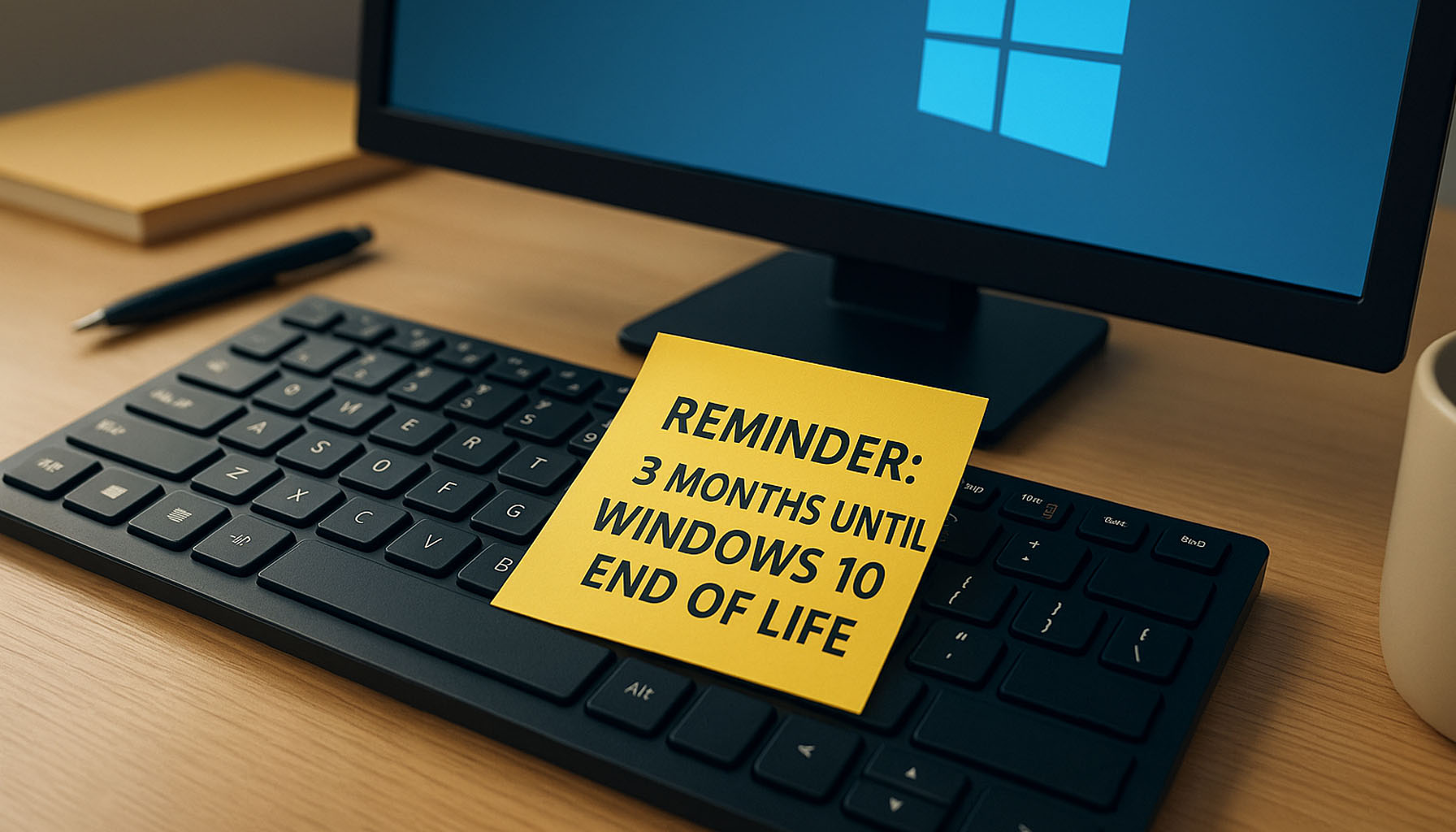

Reminder: Only 3 Months Left Until Windows 10 Reaches End of Life

By Telanova | 14 July 2025

What we do to support Microsoft 365 - User Management Email Management

By Telanova | 02 July 2025

How Managed IT Services Can Save Your Small Business Time & Money

By Telanova | 18 June 2025

Outsourced IT Helpdesk vs. In-House Support: Which is Right for Your Business?

By Telanova | 11 June 2025

Why you should ensure your laptops and other mobile devices are encrypted

By Telanova | 23 October 2024

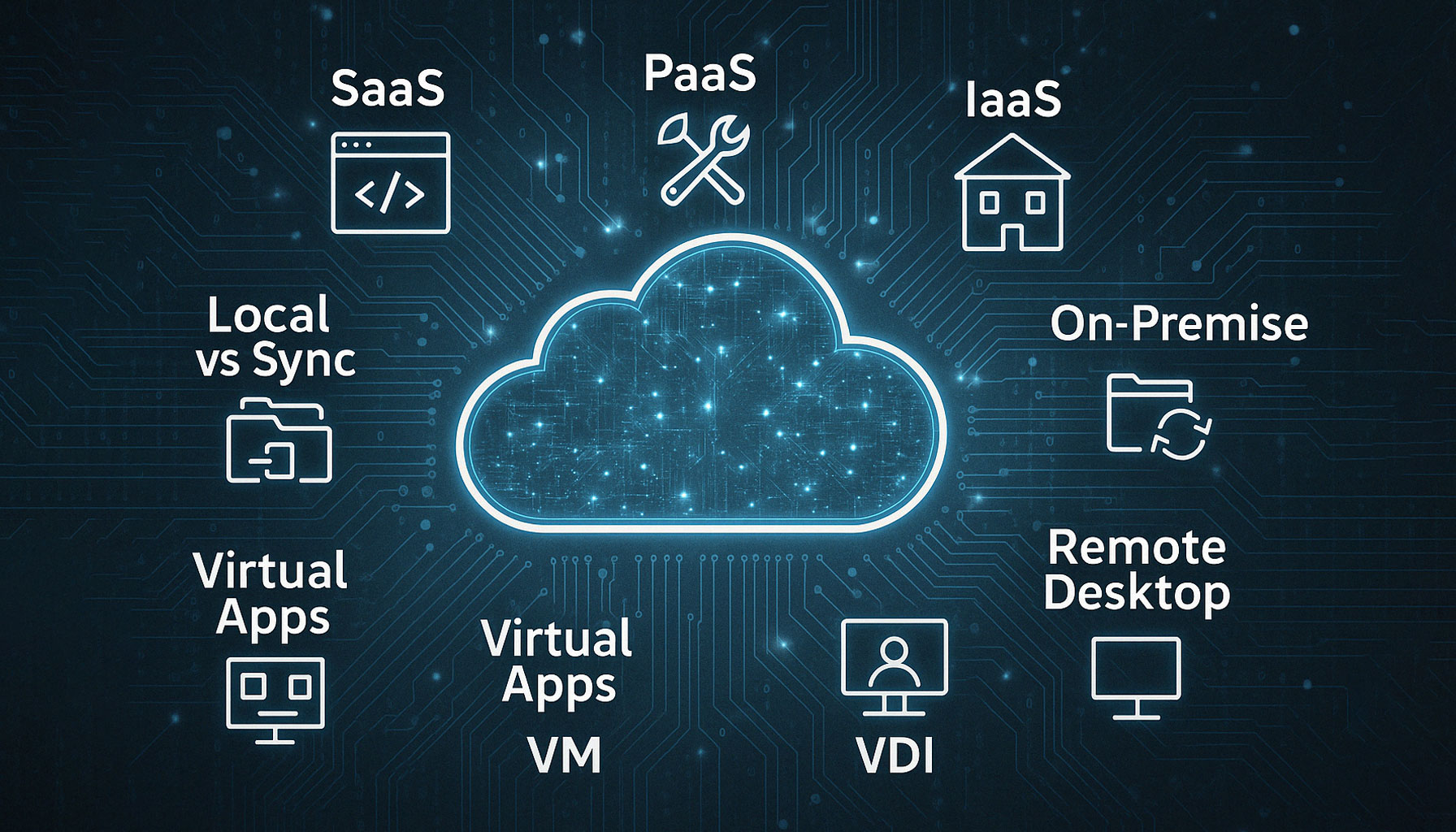

Case Study: Migrating from Cloud Remote Desktop to Pure SaaS for an Ascot-Based Business

By Telanova | 25 September 2024

WiFi or wired connections - How to get the best for your organisation?

By Telanova | 22 May 2022

Discover if WiFi or wired connections is the best for your organisation?Bring Your Own Device safely

By Telanova | 14 March 2022

Discover how to safely enable staff to bring their own devices.